Dear investors,

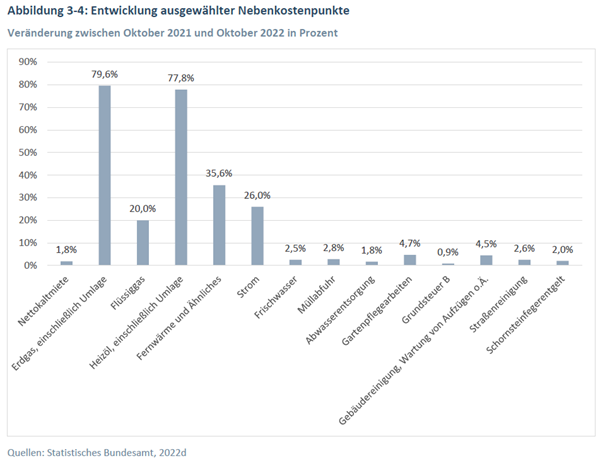

Since the previous edition of d.i.i. View, the topic of additional costs has not lost any of its explosiveness - on the contrary. These days, millions of households are receiving mail from their suppliers, and many citizens are realizing for the first time what the explosion in energy prices means for them personally. Although the federal government has launched a number of support measures, the increase in costs affects us all - and quite a few families see their financial existence threatened.

In order to cope with a difficult situation, it is not enough to complain about it. If you want to take the right measures, you have to recognize and quantify their true extent. The d.i.i. has therefore commissioned a study from the Cologne Institute for the German Economy that analyzes the development of additional costs in Germany in detail. We would like to thank the authors of the study, Prof. Dr. Michael Voigtländer and Pekka Sagner, for their excellent work, and present the most important results to you in this issue of d.i.i. View.

They show that the development of additional costs leads to a significant loss of prosperity. Political measures must therefore primarily protect low-income households. Housing companies also have options to reduce the burden on their tenants, for example with a forward-looking procurement policy and consistent energy-saving renovations. While such measures have been part of d.i.i. 's DNA for years, this potential remains unused by other players.

Kind regards, yours

Dirk Hasselbring

Head of Fund Business

Additional housing costs in Germany –

a ruthless inventory

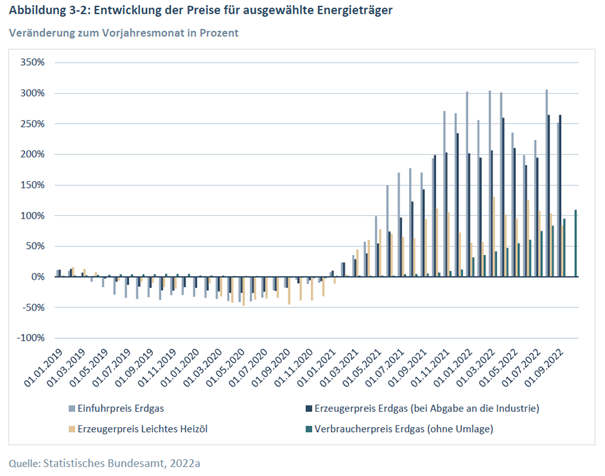

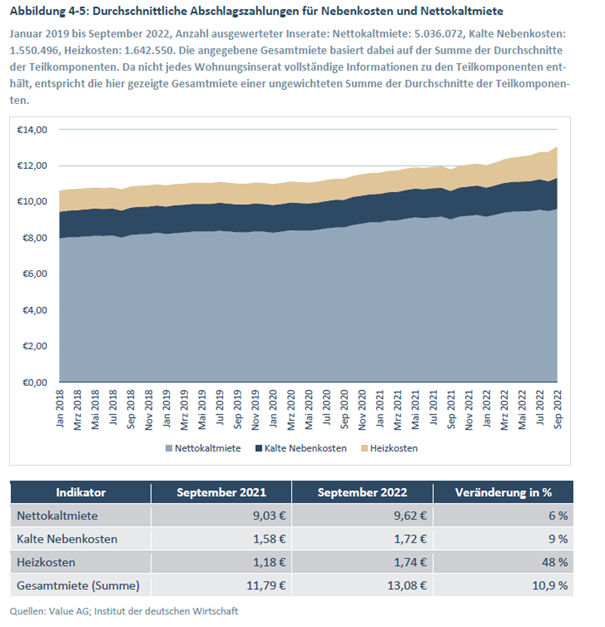

The development of energy costs is extremely politically and socially explosive. There is a risk that a significant proportion of German private households will get into serious financial difficulties due to the explosion in heating costs. The third report “Ancillary housing costs in Germany” commissioned by the d.i.i. from the German Economic Institute is therefore focused this year on so-called warm additional costs. In this issue of d.i.i. View we summarize the results.

Key findings:

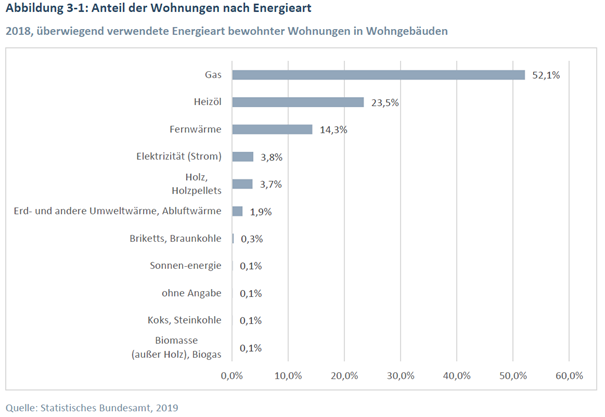

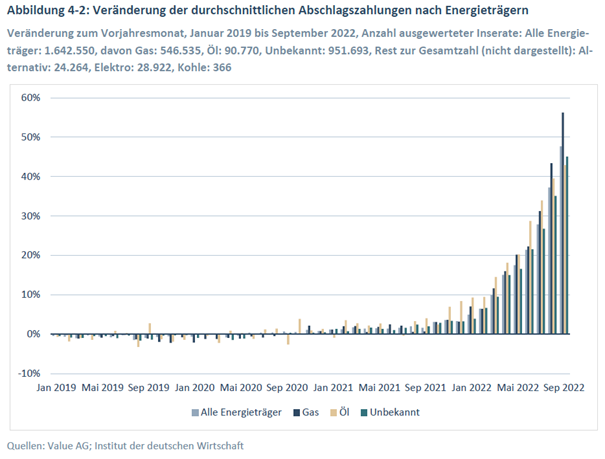

Regional differences

In almost all districts, advance payments increased in the third quarter compared to the same period last year. However, regional differences can be seen in the extent of the increases. With the exception of Thuringia, advance payments for heating costs rose less sharply in eastern Germany than in the west. A possible reason for this could be the higher proportion of apartments that are heated directly with fossil fuels. Natural gas is used relatively frequently in the northwest, while the proportion of gas is lower in the east and south. In the south, the proportion of apartments heated with oil is relatively high, while in the east, district heating is more common. In Hesse and Rhineland-Palatinate, advance payments have so far been adjusted upwards by more than 40 percent on average. In Mecklenburg-Western Pomerania and Saxony, the adjustments in the third quarter were 28.2 and 23.3 percent and were therefore the lowest in a comparison of the federal states. The larger share of district heating in the east could have had a dampening effect on landlords' price adjustments and costs for tenants.

A larger proportion of apartments are no longer affordable

The study also addressed the question of the extent to which the increased overall rents have affected the affordability of the apartments on offer. To do this, the income development was compared with the higher rents, differentiated between single households and families of four. Overall, for both groups it was found that a significantly lower proportion of the apartments on offer were still affordable than a year before. However, the decline was greater for families than for singles.

In both groups, households with lower incomes are particularly hard hit. Last year, the lowest-income 20 percent of families in half of the districts were able to afford 37 percent of the apartments on offer with four or more rooms; this year it was only 28 percent - a decline of nine percentage points.

Regardless of the question of feasibility, the affected households essentially have the following options to deal with the worsened situation:

Conclusions

The study shows that the combination of rising new contract rents and significantly higher heating costs is causing a shortage of affordable housing. This has particularly dramatic consequences for low-income households. Not only is the supply of affordable housing particularly low for them, the reduction in residual income for other expenditure items is also particularly noticeable for them.

State support measures should therefore focus primarily on the lowest-income households. The federal government has already introduced various instruments for this purpose, including the so-called gas price brake, which caps the price of 80 percent of previous gas consumption at a certain price. A one-off payment or the reform of housing benefit can also provide particular relief for households in the lower income range.

However, it is foreseeable that energy prices will remain high in the longer term. It is all the more important that housing companies consistently use the options available to them to minimize the impact on their tenants. This includes a forward-looking procurement policy. For example, long-term framework agreements with suppliers can noticeably reduce the burden on tenants. The high additional costs also create significantly stronger incentives to modernize buildings in terms of energy efficiency. In order for this potential to be used, the right political framework is required, such as a predictable funding policy, but also an adjustment of the rules for modernization levy to the increased interest and construction costs.

Your investment in safe hands

Dirk Hasselbring

Managing Director of

d.i.i. Investment GmbH

Dominik Schott

Head of Asset Management

d.i.i. Deutsche Invest Immobilien AG