In an ever-changing world where climate change is one of the biggest challenges, it is essential that all industries do their part to reduce greenhouse gas emissions. The real estate industry, as a significant player in global CO₂ emissions, has a special responsibility to promote sustainable practices and minimize impacts on the climate.

As a result of advancing global warming, adaptations to climate change are already mandatory, as the European Environment Agency (EEA) urgently stated last week in its first report on climate risk assessment (EUCRA) and I have summarized some important excerpts here with a view to the real estate industry .

Takeaways from the European climate risk assessment (EUCRA):

The European Environment Agency has published a comprehensive study on European climate risk assessment. One finding from the report is that Europe is the fastest warming continent in the world. Extreme heat, once rare, is now occurring more frequently while rainfall patterns are changing. Heavy rain and other extreme precipitation events are increasing in intensity, and in recent years there have been catastrophic floods in various regions. At the same time, significant declines in total precipitation and more severe droughts are expected in southern Europe. These events, combined with environmental and social risk factors, pose major challenges across Europe.

More takeaways:

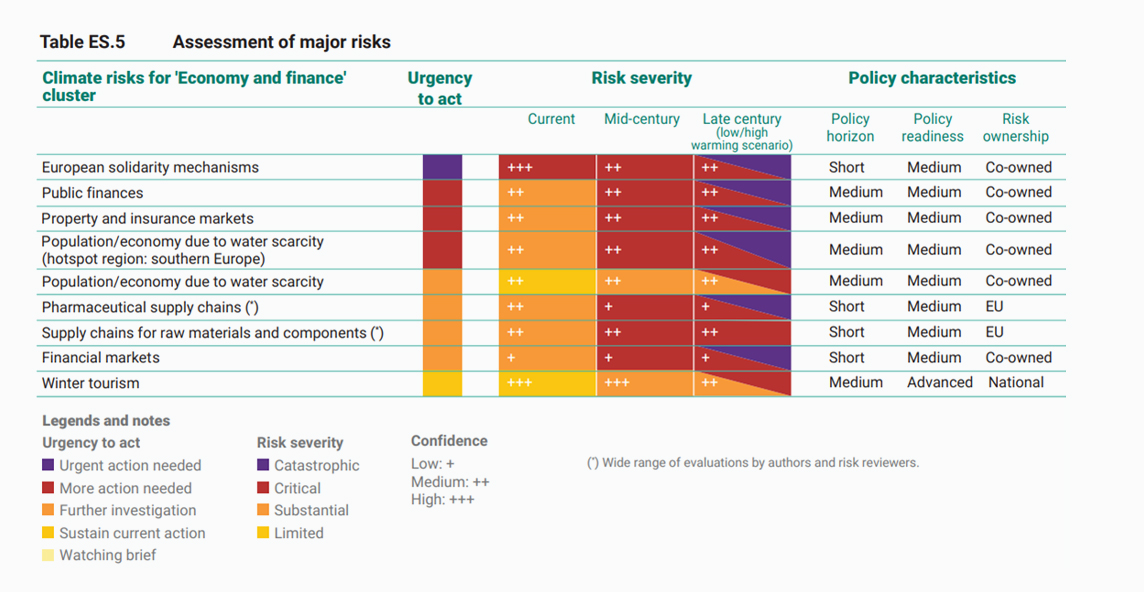

Graphic European climate risk assessment — Executive summary – Economy and finance cluster

Examples of adaptation measures to climate change:

Recommendations for action:

1: European Climate Risk Assessment – EEA

European Climate Risk Assessment — European Environment Agency (europa.eu)